Claim: An X user made a post that Nigerians pay personal income tax on monthly earnings as low as ₦30,000, (the old minimum wage) while in Kenya and South Africa, personal income tax is only applied when monthly earnings reach ₦282,000 and ₦660,000, respectively.

He attributed the statement to Taiwo Oyedele, the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee.

Full Text

President Bola Tinubu’s administration has proposed new tax reforms aimed at improving efficiency, reducing complexity, and addressing long-standing challenges in Nigeria’s taxation system.

These reforms, according to the Federal Government, are driven by the need to boost revenue without significantly increasing the tax burden on individuals and businesses, while reducing the negative impacts of multiple taxation and improving compliance.

The aims of the reforms also include doubling Nigeria’s tax-to-GDP ratio from 10.8% to around 18% by improving collection efficiency, broadening the tax base, and addressing tax evasion; harmonisation of multiple taxes, eliminating state-imposed consumption taxes, and streamlining VAT collection at the federal level to simplify processes and reduce administrative burdens for businesses.

Additionally, the reforms propose changing the VAT distribution model to favour states where goods and services are consumed, ensuring fairness and discouraging independent VAT administration by states.

To support individuals and businesses, the reforms proposed reducing PAYE taxes for low-income earners and exempting those earning minimum wage or slightly above.

Small businesses with turnovers under ₦50 million will be exempt from corporate income tax, while the general corporate tax rate is set to drop from 30% to 25% over two years.

Implications Of The Tax Reforms

These measures are designed to mitigate inflation impacts, stimulate economic growth, and attract investment.

Furthermore, technological integration will enhance revenue collection and transparency by reducing inefficiencies and eliminating duplicates among revenue agencies.

However, there has been debate about the implications of these reforms.

Critics argue that the reforms will favour some states and regions in the country over others while some government agencies, such as TetFund and NITDA, will be scrapped. These claims, the Federal government has denied.

Meanwhile, a viral post is making the rounds on social media regarding payable taxes in Nigeria, South Africa and Kenya.

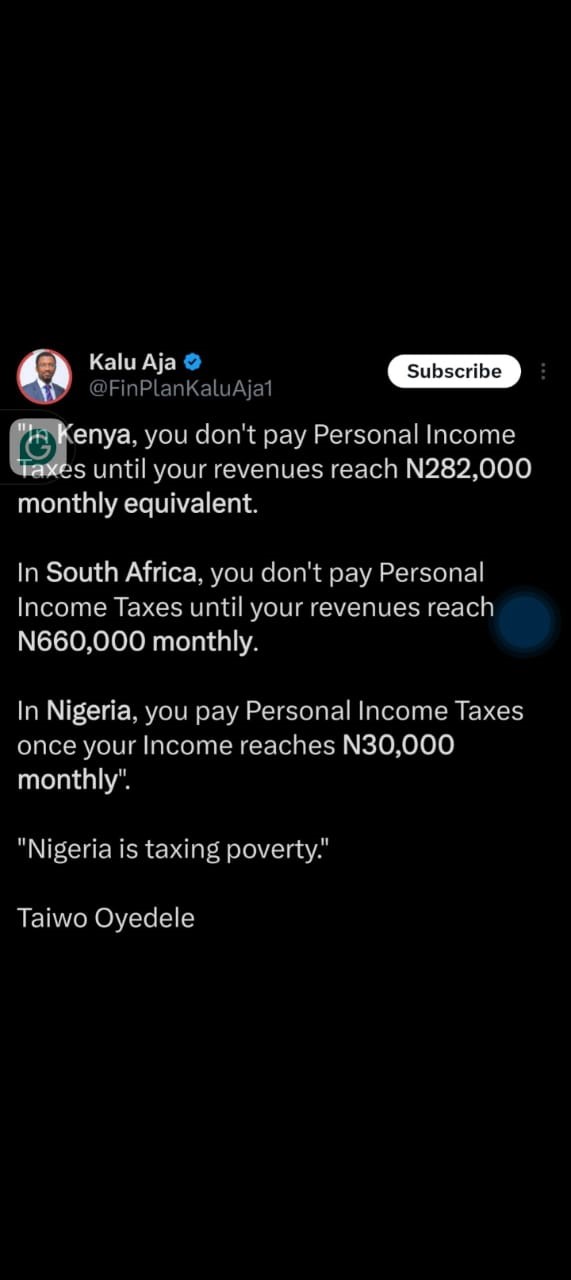

On December 2, 2024, an X user, Kalu Aja, @FinPlanKaluAja1, posted a quote, claiming that personal income taxes are not paid in Kenya and South Africa until one’s revenue reached ₦282,000 and ₦660,000, respectively but it is paid as soon as revenue reached ₦30,000 in Nigeria.

The quoted post reads: “In Kenya, you don’t pay Personal Income Taxes until your revenues

reach ₦282,000 monthly equivalent. In South Africa, you don’t pay Personal Income Taxes until your revenues reach ₦660,000 monthly. In Nigeria, you pay Personal Income Taxes once your Income reaches ₦30,000 monthly”. “Nigeria is taxing poverty.” Taiwo Oyedele”.

Screenshot of the claim

The post has attracted 139.4k views, 67 comments, 1.1k retweets, 2.4k likes and 152 bookmarks.

Also, the claim appears on Facebook, LinkedIn, Instagram and X and Thread. We observed that the claims on most platforms are written as shown on Kalu Aja’s post on X.

The name – Taiwo Oyedele – which the quote is attributed to is the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee.

His biography shows that prior to his current role, he “was the Fiscal Policy Partner and Africa Tax Leader at PwC where he worked for 22 years including over 10 years in top leadership positions gaining in-depth knowledge and diverse experience ranging from Tax Advisory & Policy Advocacy to Business Strategy Consulting, Leadership Development, and Policy Design & Execution. Mr. Oyedele is an accountant and an economist by training.”

Given the virality of the claim and its relevance to the current tax reforms debate in Nigeria, we conducted this fact-check.

We set out to verify if the content of the claim was made by Taiwo Oyedele and also to verify the current income tax payable in Nigeria, Kenya and South Africa.

Verification

According to the Federal Inland Revenue Service (FIRS), Personal income “refers to the total earnings or revenue received by an individual from various sources during a given period, typically a financial year.

It encompasses all the money an individual earns from different activities and sources, both employment-related and non-employment-related.

“All Nigerian residents aged 18 and above, including salaried employees, self-employed individuals, and those earning from investments or rentals, must file personal income tax returns.

Members of the armed forces with employment income are also required to file annual returns.

Additionally, non-residents earning Nigerian-sourced income are obligated to file tax returns.”

We used Google keywords to search the minimum income anyone must earn before they can pay personal income tax in Nigeria, Kenya and South Africa.

Did Oyedele Make The Statement?

We used keyword search on Google to verify if Taiwo Oyedele actually made the quoted texts attributed to him.

We found a July 17, 2022 news report by Nairametrics, entitled: “Nigeria is taxing poverty”.

According to the news report, Oyedele berated the Nigerian government for taxing poverty, urging it to explore an inclusive economic growth rate that would focus on taxes, reduce the economic burden on SMEs, and increase the tax net of non-paying upper middle-class institutions, especially the MDAs.

He was said to have made the remarks during Nairametrics Economic Outlook webinar held on Saturday, July 16, 2022.

However, we could not find any mention of the personal income tax thresholds in Nigeria, Kenya and South Africa in the report.

We wrote an email to Nairametrics regarding the webinar and to confirm if Oyedele gave the PIT figures highlighted in the viral claim during the 2022 webinar.

We are yet to hear from Nairametrics as of the time this report was filed. Also, that was not captured in the report published from that gathering by the same Nairametrics.

Furthermore, we found a Punch Newspaper report of October 5, 2024, entitled: “Nigeria can’t become wealthy taxing poverty, says Oyedele.”

Oyedele stated that the most vulnerable persons in Nigeria had been paying multiple taxes while the middle and upper classes, alongside politicians, had been evading tax.

Personal Income Tax In Nigeria

In Nigeria, individuals earning ₦300,000 and above annually are required to pay personal income tax, as stipulated by the Personal Income Tax Act (PITA) of 2011, which was amended in 2020. The tax rates are progressive, starting from 7% for taxable incomes over this threshold.

There are also allowances and reliefs, but in practice, a salary of ₦30,000 monthly would generally trigger personal income tax liability.

According to PricewaterhouseCoopers (PwC), employees who earn not more than the national minimum wage (NGN 30,000 till 30 April 2024 and NGN 70,000 effective 1 May 2024) are no longer liable to tax or deduction of monthly PAYE.

Therefore, the information that Nigerians pay personal income tax on incomes starting from ₦30,000 monthly is true, given that ₦30,000 was the minimum wage before President Bola Ahmed Tinubu approved ₦70,000 as the new minimum wage.

Personal Income Tax In Kenya

Several sources, including the Kenya Revenue Authority (KRA) showed that effective from July 1, 2023, the minimum taxable personal income in Kenya is 24,000 Shillings monthly. This can also be found here and here.

Foreign Exchange shows that a Kenya Shilling exchanges for ₦12.0164 as of December 16, 2024, giving a total of ₦288,393.6. A similar figure was obtained from Currency Rate.

As of December 2, 2024, Foreign Exchange showed that 1 Ksh equalled ₦12.8873, which equated 24,000 Ksh to ₦309,295.2. The 24,000 personal income threshold attracts a 10% tax deduction.

Therefore, the information that personal income tax in Kenya is only paid when revenues reach ₦282,000 monthly is slightly inaccurate. The figures obtained are close to, but not exactly, ₦282,000.

Personal Income Tax In South Africa

In South Africa, the minimum personal income one must earn before being taxed depends on the individual’s age.

The minimum income for anyone below 65 years is R95,750 for individuals under 65 years, which translates to approximately R7,979 monthly, around ₦691,483 in Nigeria. This is calculated at 1 ZAR = 86.8761 NGN.

At the Central Bank of Nigeria (CBN) rate – 1 ZAR = 85.8026 NGN – one must earn ₦684,598.2 in South Africa before paying an income tax.

Those between 65 and 75 years must earn R148,217 annually to be taxed while those from 75 years and above must earn R165 689. Information on personal income tax in South Africa can also be found here and here.

As of December 2, 2024 that Kalu Aja made his post, 1 ZAR traded between ₦92.054 and ₦93.0196 (the average is ₦92.5365.). Given the average, the minimum personal income that was taxable in South Africa as of December 2, 2024 was ₦738,348.73.

Therefore, the information that South Africans pay personal income tax only when earning ₦660,000 monthly equivalent is inaccurate.

The minimum taxable income for individuals under 65 in South Africa is R95,750 annually, translating to approximately ₦691,483 to ₦738,349 monthly based on exchange rates.

Who Made The Post?

Kalu Aja made the claim. We used Google keywords to check his profile. We found that he is a Certified Financial Education Instructor and astute professional with extensive experience in capital market operations, Treasury, investment, asset management, and occupational pension services.

He has appeared on the Nigerian television Authority (NTA), African Independent Television (AIT) and Daily Post Nigeria, among other media features.

Also, he is the owner of Financial Planning and author of “Let’s Talk About Your Money”. His LinkedIn profile shows that he studied at the New York Institute of Finance (Fixed Income), University of Nsukka (MBA Marketing) and Lagos Business School (Business Administration and Management) and has worked with Fidelity Bank, AGM, BGL Limited and UAC of Nigeria Plc.

Given his profile as a Certified Financial Education Instructor and his experience in the financial sector, we can attach some level of credibility to him.

Confusion

We must admit that the post made by Kalu Aja that was reposted on other platforms is confusing.

First, he quoted the texts, which might indicate that the texts are not his words. At the end of the texts, he put Taiwo Oyedele.

One of his followers, HB Henz, mentioned that he should explain his posts so his followers can understand.

Although he said it in a condescending manner, he commented that: “Majority of ur followers are dunce. They don’t know the meaning of the post u posted….. Pls oga wen posting try to use layman explanation for them or wen u post something like this try to explain it to them so they don’t continue in disgracing u and themselves (sic).

Conclusion

Our investigation has established that Taiwo Oyedele said that Nigeria is taxing poverty.

However, we could not find a credible source attributing the figures about personal income tax in Nigeria, Kenya and South Africa to him.

In addition, the figures given about personal income taxes in Nigeria, Kenya and South Africa are partially inaccurate.

While Nigerians pay personal income tax starting at ₦30,000 monthly, the thresholds for Kenya and South Africa are higher than stated, approximately ₦288,394 and ₦691,483, respectively.